Key Points of SaaS Statistics Report 2025

- Research suggests the SaaS industry is growing significantly in 2025, with projections indicating a market size of around $315 billion to $317 billion, up from 2024.

- It seems likely that SaaS revenue will see an annual growth rate of about 19.38% from 2025 to 2029, potentially reaching $793.10 billion by 2029.

- The evidence leans toward increased adoption, with 85% of business applications expected to be SaaS-based by 2025, driven by AI and automation trends.

Table of Contents

The Software as a Service (SaaS) industry has become a cornerstone of modern business operations. It is fundamentally reshaping how organizations access and utilize software.

By delivering applications over the internet on a subscription basis, SaaS offers unparalleled flexibility, scalability, and cost-efficiency compared to traditional on-premises software models.

This fundamental change has allowed businesses to adapt quickly to changing market demands. It also helps to streamline operations and drive innovation. This is achieved without the need for extensive IT infrastructure or large upfront investments.

As we step into 2025, the SaaS industry continues its remarkable growth trajectory. This growth is propelled by technological advancements, evolving workplace dynamics, and the accelerating pace of digital transformation across industries.

This report will provide a detailed exploration of the SaaS business statistics for the first quarter (Q1) of 2025, alongside informed predictions for the second quarter (Q2).

This report uses the latest data, trends, and projections. The aim of this report is to deliver a comprehensive, informative, and resourceful analysis. Readers will be equipped with valuable insights into the current state and future direction of the SaaS landscape.

From market size and adoption rates to investment trends and technological drivers, this article covers the key factors shaping the industry’s evolution.

Summary Table of Key SaaS Statistics for 2025

| Metric | Value |

| Global SaaS Market Size (2025) | $315.68 billion to $317 billion |

| Annual Growth Rate (2025-2029) | 19.38% |

| End-User Spending Projection (by 2027) | >$1 trillion |

| SaaS-Based Applications (by 2025) | 85% of all business apps |

| AI-Enabled Apps Deployment (by 2026) | >80% of companies |

| Automation Impact | 90% IT pros see key, 64% report reduced manual work |

SaaS Business Statistics for Q1 2025

SaaS Market Size and Growth

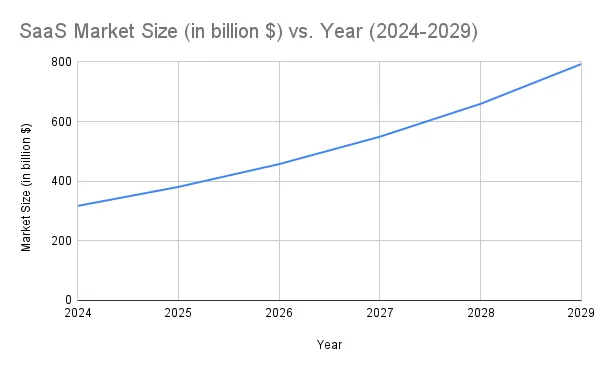

In 2024, the global SaaS market was valued at over $317 billion, reflecting its strong growth and widespread acceptance across sectors. This valuation sets the stage for further expansion in 2025, with forecasts indicating that the SaaS market will grow at an impressive compound annual growth rate (CAGR) of 19.38% from 2025 to 2029.

If this trajectory holds, the market could reach an astounding $793.10 billion by 2029, underscoring the industry’s long-term potential and resilience.

For Q1 2025, we can infer that the market likely continued its upward momentum from 2024. Assuming a consistent growth pattern, the SaaS market may have expanded by approximately 4-5% in the first quarter alone, aligning with the annual growth rate when adjusted for seasonality and economic factors.

This growth is driven by the increasing reliance on cloud-based solutions as businesses seek to optimize costs, enhance operational efficiency, and remain competitive in a digital-first world.

SaaS Industry Adoption Trends

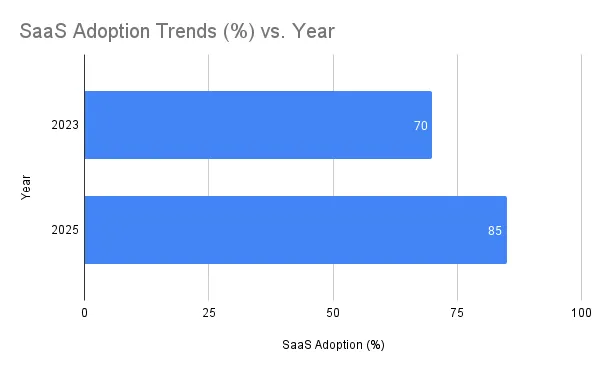

One of the most striking indicators of the SaaS industry’s strength is its rapid adoption across enterprises of all sizes. Projections suggest that by the end of 2025, 85% of all business applications will be SaaS-based, a significant jump from 70% in 2023.

This 15% increase over two years highlights the accelerating shift toward cloud solutions, fueled by their inherent advantages: lower upfront costs, automatic updates, and accessibility from any location with an internet connection.

The rise of remote work and hybrid work models has further accelerated this trend. Collaboration tools such as Slack, Microsoft Teams, and Zoom – all SaaS-based have become essential for maintaining productivity among distributed teams.

Similarly, customer relationship management (CRM) platforms like Salesforce and enterprise resource planning (ERP) systems like NetSuite are seeing heightened demand as organizations prioritize seamless, scalable solutions to support their operations.

In Q1 2025, this adoption surge likely solidified SaaS as the dominant software delivery model, reshaping IT strategies across industries.

Technological Advancements

Technological innovation, particularly in artificial intelligence (AI) and automation, has been a key driver of SaaS growth in Q1 2025. AI-powered features are increasingly embedded in SaaS applications, enhancing their functionality and value proposition.

For instance, CRM platforms now leverage AI to deliver predictive analytics and personalized customer insights, while marketing automation tools use machine learning to optimize campaigns and improve targeting precision. These advancements enable businesses to operate more efficiently, reduce manual workloads, and make data-driven decisions with greater accuracy.

In Q1 2025, the integration of AI and automation likely contributed to increased customer satisfaction and retention, as SaaS providers delivered more sophisticated and tailored solutions.

This technological evolution not only improves operational outcomes but also creates new opportunities for SaaS companies to differentiate themselves in a crowded market, further fueling growth.

Investment Landscape

Investment in the SaaS sector has remained a significant catalyst for its expansion. In 2024, venture capital (VC) funding for tech startups, including SaaS companies, rose by 21% year-over-year, reaching $184 billion.

This surge reflects investor confidence in the SaaS model’s ability to generate consistent, recurring revenue – a hallmark of its financial stability and appeal. In Q1 2025, this trend likely continued, with VC funding supporting both emerging startups and established players as they innovate and scale their offerings.

The influx of capital has enabled SaaS companies to invest in research and development, expand into new markets, and enhance their product portfolios. For example, startups focusing on niche verticals – such as healthcare SaaS or legal tech – may have gained traction in Q1 2025, leveraging funding to address specific industry pain points with tailored solutions.

This investment momentum underscores the industry’s attractiveness and its capacity for sustained growth.

SaaS Growth Predictions for SaaS Growth Q2 2025

Continued Growth and AI Integration

Looking ahead to Q2 2025, the SaaS industry is poised for continued expansion, with AI and automation serving as primary growth drivers.

By 2026, more than 80% of companies are expected to deploy AI-enabled applications, up from just 5% in 2023. In Q2 2025, we can anticipate that this trend will gain further momentum, with SaaS providers rolling out increasingly intelligent and automated solutions.

For example, AI-driven customer support tools, such as chatbots capable of handling complex queries in real time will likely become standard offerings, reducing response times and enhancing user experiences.

Similarly, analytics platforms powered by AI will enable businesses to uncover actionable insights from vast datasets, driving strategic decision-making.

This deepening integration of AI will not only boost adoption rates but also position SaaS providers as indispensable partners in business success, shaping the competitive landscape in Q2.

Managing SaaS Spending and Churn

As SaaS adoption grows, so does the complexity of managing multiple subscriptions, a challenge that will come into sharper focus in Q2 2025.

In Q4 2023, new software purchases accounted for 11% of total SaaS spend, a figure projected to drop to 8% by Q1 2024 as companies prioritized optimization over expansion.

This trend is likely to persist into 2025, with businesses in Q2 focusing on consolidating their SaaS portfolios, eliminating redundancies, and maximizing the value of existing subscriptions.

Churn – the rate at which customers cancel subscriptions will remain a critical concern for SaaS providers. To combat this, companies are expected to double down on customer success initiatives in Q2 2025, leveraging data analytics and AI to identify at-risk customers and address their needs proactively.

Flexible pricing models, such as usage-based pricing, may also gain traction, aligning costs with actual usage and enhancing customer satisfaction. By reducing churn and improving retention, SaaS providers can strengthen their revenue streams and maintain growth momentum.

Opportunities and Challenges

The SaaS industry’s outlook for Q2 2025 is overwhelmingly positive, with the market’s projected growth to $793.10 billion by 2029 reflecting sustained demand for cloud-based solutions. The ongoing shift toward digital transformation, coupled with the rise of remote work, will continue to create opportunities for SaaS providers to innovate and expand.

For instance, collaboration tools, cybersecurity solutions, and industry-specific SaaS applications are likely to see heightened demand as businesses address evolving needs.

However, challenges such as market saturation and economic uncertainty could pose risks. As the SaaS market matures, providers may face increased competition, necessitating differentiation through superior features, pricing, or customer support.

Additionally, macroeconomic factors, such as inflation or shifts in IT budgets could influence SaaS spending in Q2 2025, requiring providers to adapt quickly to changing conditions.

Additional Insights

Global Expansion

The SaaS industry’s growth is not confined to a single region; it is a global phenomenon. The United States, home to approximately 17,000 SaaS companies, remains the largest market, but other regions are catching up.

In Europe, the UK and Germany lead the way, with the continent’s SaaS revenue projected to reach $61.04 billion in 2023. Meanwhile, Australia’s SaaS sector is expected to grow to $4.43 billion in 2023, driven by successful players like Atlassian and Canva.

In Q1 2025, this global expansion likely continued, with emerging markets in Asia and Latin America contributing to the industry’s growth. This diversity fosters innovation and competition, as SaaS providers worldwide bring unique solutions to the table, enriching the overall ecosystem.

Enabling Digital Transformation

SaaS plays a pivotal role in enabling digital transformation – a priority for businesses across industries. By providing accessible, scalable tools for CRM, ERP, human resources, and more, SaaS solutions help organizations modernize their operations and embrace new technologies.

In Q1 2025, this role likely became even more pronounced, as companies leaned on SaaS to navigate digital challenges and stay ahead of the curve.

The subscription-based model also ensures a predictable revenue stream for providers, allowing them to invest in continuous improvement and support. This dynamic benefits customers, who receive regular updates and enhancements, keeping their software aligned with evolving business needs.

Conclusion

The SaaS industry stands at a pivotal moment in 2025, balancing robust growth with the need for strategic resource management and customer-centric innovation.

In Q1 2025, the industry likely maintained its upward trajectory, with a market size exceeding $317 billion, adoption rates climbing to 85%, and significant investments fueling further expansion.

Looking to Q2, the integration of AI and automation, alongside efforts to manage churn and optimize spending, will shape the industry’s path forward.

As the SaaS market evolves, its ability to adapt to technological advancements, address customer needs, and navigate competitive pressures will determine its success. For businesses, staying informed about these trends and statistics is essential for leveraging SaaS to drive growth and innovation.

By embracing the opportunities and tackling the challenges ahead, the SaaS industry will continue to redefine the future of business operations, delivering value to organizations worldwide.

Sources:

- 85 SaaS Statistics, Trends and Benchmarks for 2025

- Software as a Service [SaaS] Market Size, Global Report, 2032

- SaaS market size worldwide 2025

- The Future of SaaS: Top Trends and Predictions in 2024 and Beyond

- 17+ SaaS Statistics 2025 (Industry Trends & Growth Rates)

- SaaS Statistics and Trends You Can’t Ignore in 2025

- 80+ SaaS Statistics and Trends (2024)

- 50+ Key SaaS Statistics & Trends Explained Quickly 2025

- 2025’s Top SaaS Trends to Watch

- 46 SaaS Industry Stats and Insights for 2024

- How To Start a SaaS Business In 2025?

Leave a Reply